| When disaster strikes, “Does home insurance cover my garage door?” is an important question that can influence how you budget repairs. In most policies, homeowners insurance covers attached garages when a covered peril occurs. |

Is your garage door covered by homeowners insurance? This depends on your specific policy and the damage your garage door has sustained, but in most cases, the answer is yes. Let’s discuss when your garage door often is and isn’t covered by homeowners insurance so you can properly budget for garage door replacement or repair.

Table of contents:

- Damage That Homeowners Insurance May Cover

- Damage Typically Not Covered by Homeowners Insurance

- How To File a Garage Door Claim

- Benefits of Upgrading Your Garage Door

- Trust Precision Garage Door Service for Repairs

- Home Insurance Garage Door Coverage FAQ

Damage That Homeowners Insurance May Cover

Dwelling coverage is under the umbrella of basic homeowners insurance coverage. It helps cover the cost of repairs if something happens to your home’s physical structure. It also includes coverage for attachments to your home, such as attached garages and decks.

If your garage isn’t attached, then your homeowners insurance might not cover it. To learn whether your unattached garage is covered, check your policy or contact your insurance agent.

Not every type of accident or damage is covered by homeowners insurance. We’ll discuss the types of damage that are generally covered, including:

No insurance policy — or its coverage — is one size fits all. Refer to your specific homeowners insurance policy or contact your agent to determine which types of damage are covered for your garage door repair or replacement. Your policy will also tell you what your deductible is if you choose to use your insurance for garage door repair or replacement purposes.

Vehicle damage

The majority of home insurance policies cover damage to your garage door if it's hit by a vehicle. However, since every policy and circumstance is different, check your policy or contact your agent directly.

If your homeowners insurance doesn’t cover the repair, don’t risk DIY garage door repair — there’s a good chance auto insurance would cover it. Whoever hit the garage should file a claim through their auto insurance to see whether it’s covered.

Fire damage

Fire is a common covered peril under homeowners insurance. Just as your insurance can help cover the cost of repairs in your home after a fire, it can cover garage repairs if the fire impacts your garage.

Some fires, such as those caused by arson, aren’t covered by homeowners insurance. If your garage is included in your policy and the cause of the fire isn’t exempt from your policy, then it should be covered.

Refer to your policy or contact your agent for more details.

Natural disasters

Homeowners insurance typically covers damage from some natural disasters such as wind, hail, lightning, snow, or falling objects. If your garage door is damaged during one of these natural disasters, homeowners insurance will likely cover it as long as the specific disaster is a covered peril in your policy.

However, coverage for events such as flooding, mudslides, or earthquakes are usually separate policies.

Contact your insurance agent or provider to determine whether you have coverage for a specific natural disaster or event.

Vandalism and theft

Homeowners insurance usually covers garage vandalism or theft. It may not replace all stolen items, but it will typically cover garage door repair or replacement if the door was damaged during the break-in. For more information on what your homeowners insurance covers, contact your insurance provider or agent.

Garage Door Damage That Typically Isn’t Covered by Homeowners Insurance

As thorough as different homeowners insurance coverage policies are, there are some instances in which it’s unlikely to cover garage door damage. You can purchase policy upgrades, such as flood insurance, for broader coverage, but no policy will cover everything.

Here are a few typical exclusions:

General wear and tear

Homeowners insurance won’t cover any damage incurred from regular use of your garage, such as the examples below:

- Wear and tear: If your garage door is bent out of shape simply because of its age, your insurance won’t reimburse you for associated repair or replacement costs.

- Poor upkeep or maintenance: If something happens to your garage door due to irregular or improper maintenance, your insurance probably won’t cover it. This is one reason why our experts recommend regular garage door tune-ups.

Intentional damage by residents

It’s important to note that insurance policies don’t cover deliberate damage, whether that be by the homeowner or someone the homeowner is responsible for. For this reason, it’s usually necessary to have some sort of video or photo proof of the cause of damage.

Floods, earthquakes, and wildfires

The majority of basic homeowners insurance policies don’t cover events called “acts of God,” such as floods or earthquakes. If you live in an area that’s prone to either of these natural disasters, contact your agent for details about adding these upgrades to your policy to protect your garage door and other property.

Business usage

If you run a business from your garage, your insurance company may not cover the cost of any damages to your garage door, particularly if that damage occurs from business activities.

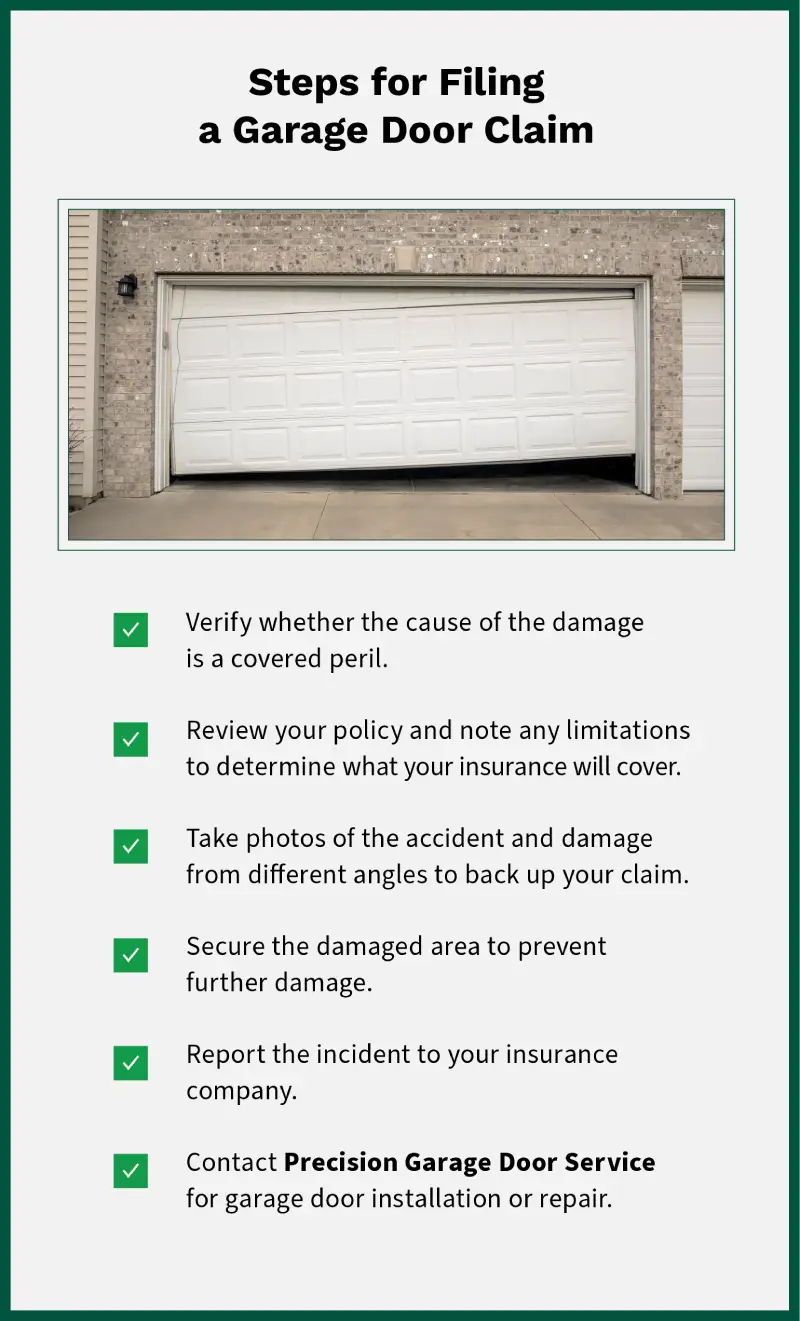

How To File a Garage Door Claim in 6 Steps

When an accident occurs, and your garage door is the victim, it’s time to file a claim. To file a home insurance claim for your garage door, we recommend taking the following steps:

- Verify the cause of the damage and check to see whether it’s a covered peril under your insurance policy.

- Review your policy to prepare for any deductible that you’ll need to pay before the insurance kicks in. You may also want to note any policy limitations to determine how much damage your insurance will cover.

- Take photos of the damage from different angles. This will help establish credibility for your claim.

- Secure the damaged area of your garage door to prevent further damage.

- Call your insurance company to report the incident. Your insurance company will pair you with a claims adjuster who will investigate the incident. After their investigation, your claims adjuster will determine an appropriate amount for your settlement.

- Contact a trusted garage door service such as Precision Garage Door Service® for your garage door installation or repair.

Benefits of Upgrading Your Garage Door

If your garage door is damaged in an accident, it’s a great opportunity to upgrade to a newer model to suit your needs better. Some benefits of upgrading your door include:

- Enhances curb appeal

- Boosts your home value

- Reduces noise

- Improves insulation

Trust Precision Garage Door Service for Repairs

Accidents happen — we’re here to help you pick up the pieces and repair your garage after whatever life throws at you. We’ll get your repair or replacement done right under the Neighborly Done Right Promise®.

If you still have questions about whether your homeowners insurance covers garage damage, please contact your insurance agent directly for details.

Once you’re ready for repair, contact Precision Garage Door Service or find the location nearest you.

This article is intended for general informational purposes only and may not be applicable to every situation. You are responsible for determining the proper course of action for your home and property. Precision Garage Door Service is not responsible for any damages that occur as a result of this blog content or your actions. For the most accurate guidance, contact the Precision Garage Door Service location nearest you for a comprehensive, on-site assessment.

Home Insurance Garage Door Coverage FAQ

As a garage door service, repair, and installation leader renowned for integrity and dependability, all independently owned and operated Precision Garage Door Service locations are committed to your satisfaction. This commitment includes using our expertise and years of experience to answer your garage door-related questions.

Here are answers to some of the most frequently asked questions about home insurance garage door coverage.

Do home warranties cover garage doors?

No, home warranties typically don’t cover garage doors. Check your policy to verify whether they are covered.

Does renters insurance cover garage doors?

No, renters insurance typically doesn’t cover garage doors. You’ll have to check with your insurance provider to see whether it does.

Does home insurance cover garage door springs?

Whether home insurance covers garage door springs depends on your policy and how the spring was damaged. If your policy covers your garage and the spring breaks due to a covered peril, it should cover garage spring repair.

Does home insurance cover garage door openers?

Yes, home insurance can cover a garage door opener, but only if it’s damaged by a covered peril. Covered perils, such as an electrical fire or break-in, should be outlined in your policy.